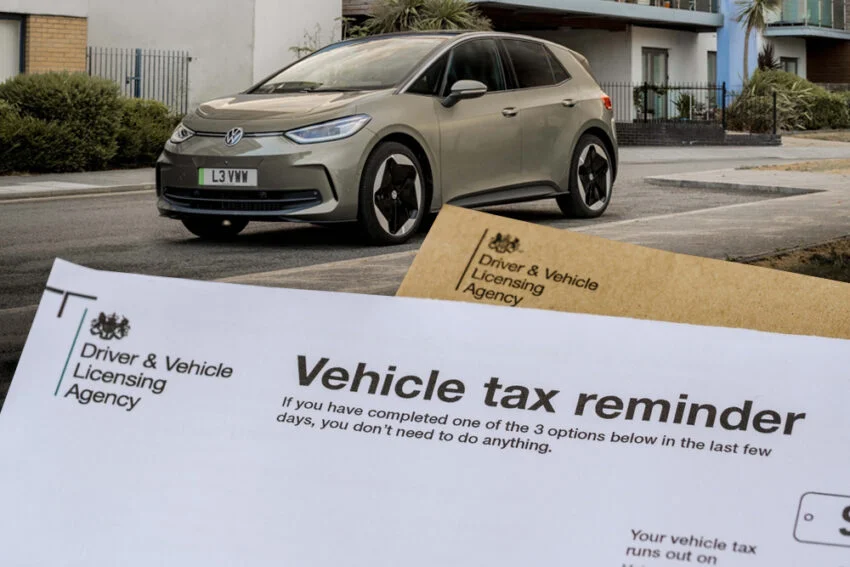

Pennsylvania Introduces $200 Annual Electric Vehicle Tax in 2025

Pennsylvania is gearing up for a significant change in its automotive landscape as Governor Josh Shapiro signs a bill introducing an electric vehicle tax starting January 1, 2025. The upcoming law will mandate that individuals, with plug in hybrid cars pitch in, for road upkeep expenses a duty typically handled by drivers of gasoline powered vehicles through fuel levies.

The Nuts and Bolts of the New Electric Vehicle Tax

The electric vehicle tax will start at $200 annually for fully electric vehicles and $50 for plug-in hybrids. The charge will be included in the vehicle registration procedure. Following the year the fee, for cars will rise to $250 with adjustments for inflation in the following years. The Pennsylvania Department of Transportation is considering ways to enable drivers to pay the electric vehicle tax on a basis which could help alleviate the strain, on EV owners.

Bridging the Revenue Gap

State Senator Greg Rothman, the bill’s sponsor, argues that the electric vehicle tax is necessary to replace the existing Alternative Fuels Tax, which has been in place since 1997. The existing system, which imposes taxes on gasoline vehicles has been criticized as “complex and often overlooked.” The introduction of this fee is intended to streamline the procedure and guarantee that all vehicle owners play their part, in supporting road upkeep.

Comparing Costs: EVs vs. Gas-Powered Vehicles

The electric vehicle tax was calculated based on the average annual gas tax paid by owners of conventional vehicles. Legislators have decided that electric vehicles should pay $290, in taxes based on an assumption of driving 12,000 miles per year. This approach aims to create a balance between cars and traditional gasoline powered vehicles regarding their contributions, towards road usage.

The EV Community Responds

The introduction of the electric vehicle tax has sparked debate within the EV community. John Belak, president of the Three Rivers Electric Vehicle Association in Murrysville, expresses skepticism about the bill’s intentions. He sees the tax as an obstacle, to shifting from traditional petrol engines to electric cars, a key component of national sustainability goals focused on cutting down U.S. Greenhouse gas emissions.

A National Trend in EV Taxation

Pennsylvania isn’t blazing a new trail with this electric vehicle tax. 36 other states have already put in place comparable charges acknowledging the necessity to tackle the financial shortfall resulting from the growing popularity of electric cars. With an increasing number of drivers transitioning to EVs revenues, from gas taxes have been decreasing leading states to explore funding options for maintaining roads.

The Search for Equitable Solutions

While the electric vehicle tax aims to create fairness, some argue that it may not be the most equitable approach. The Electrification Coalition, a profit group advocating for the adoption of electric vehicles proposes that implementing a mileage based user fee or a vehicle miles traveled fee for all cars could offer a fairer approach, to funding road maintenance.

Impact on EV Adoption

As Pennsylvania implements its electric vehicle tax, questions arise about its potential impact on EV adoption rates. In the year 2023 electric cars and plug in hybrids made up 6% of the vehicle sales, in the state an increase from 4.1% in 2022. It’s uncertain how this recent tax change could impact the rising trend, in these types of vehicles.

The Cost-Benefit Analysis of EV Ownership

Despite the new electric vehicle tax, EV advocates argue that the overall cost of ownership for electric vehicles remains lower than that of gas-powered cars. Noah Barnes, who serves as the communications director, for the Electrification Coalition highlights that although electric vehicles may have an cost their fuel and maintenance expenses are notably lower, throughout the lifespan of the vehicle.

The Future of Road Funding

As the automotive landscape continues to evolve, the electric vehicle tax in Pennsylvania represents just one approach to addressing the changing dynamics of road funding. The ongoing discussion, on this matter is expected to persist as states in the country struggle to find a balance, between encouraging transportation choices and ensuring the upkeep of essential infrastructure.

Final Thought

While the new electric vehicle tax in Pennsylvania aims to create a more equitable system for road maintenance funding, it has ignited discussions about the best ways to support infrastructure in an increasingly electrified automotive future. In 2025 when this policy is implemented policymakers, environmentalists and drivers will closely monitor how it influences the adoption of vehicles, road funding and transportation policies, in general.